Oxford Economics is a leader in global forecasting and quantitative analysis and a specialist in modelling. Visit QaurumSM for important disclosures about Oxford Economics’ data, as well as a detailed description of the available scenarios; the assumptions underlying and data used for each scenario; and its respective hypothetical impact on gold demand, supply and performance.

Mercer European Asset Allocation Insights 2020, August 2020

Refinitiv, How do ESG scores relate to financial returns, August 2020.

Gold and climate change: Current and future impacts, October 2019

An institutional investor holds and/or manages assets for clients in larger, pooled portfolios often represented as mutual funds, banks, brokerages, hedge funds, etc.

Willis Towers Watson, Global Pension Assets Study 2021, February 2021 and Global Alternatives Survey 2017, July 2017.

31 December 2000 to 31 December 2020.

See Chart 13 on p9 for more details behind the composition of the hypothetical US pension fund average portfolio. Based on 2000 – 2020. In addition, refer to important disclaimers and disclosures at the end of this report.

January 1971 – December 2020.

During the gold standard, the US dollar was backed by gold, and the foreign currency exchange rates were dictated by the Bretton Woods System. In August 1971, the Nixon Administration announced the halt of the free conversion between the US dollar and gold catalysing the collapse of the gold standard and, subsequently, the Bretton Woods system.

For other return metrics and performance see Appendix II on page 17.

See Chart 18a, on page 15.

Based on average annual CPI changes for the US (3.9%) and world (9.3%) as measured by the IMF from December 1971 – December 2020.

Oxford Economics, The impact of inflation and deflation on the case for gold, July 2011.

Ibid footnote 9.

From December 2001 – December 2020. See the Demand and Supply section at Goldhub.com.

For more information please see The impact of monetary policy on gold and It may be time to replace bonds with gold.

Based on the LBMA Gold Price PM from 1 December 2007 to 27 February 2009.

Based on the LBMA Gold Price PM from 1 October 2018 to 27 December 2018 and from 31 January 2020 to 31 March 2020.

Re-sampled efficiency is a methodology developed by Richard and Robert Michaud and praised as a robust alternative to traditional mean-variance optimisation. See Efficient Asset Management: A Practical Guide to Stock Portfolio Optimization and Asset Allocation, Oxford University Press, January 2008.

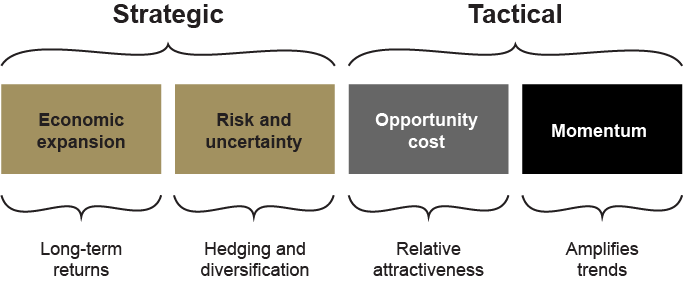

Gold as a tactical inflation hedge and long-term strategic asset, July 2009, July 2009.

Enhancing the performance of alternatives with gold, February 2018.

See: Gold: the most effective commodity investment, and Gold: metal by design, currency by nature, Gold Investor, Volume 6, June 2014.

For more information on the gold weight increases see: Major commodity indices will increase gold weightings for a second year in a row.

Gold: the most effective commodity investment, September 2019.

Average annualised returns in US dollars from January 1971to December 2020.

See Chart 22 p17.

The Greenhouse Gas Protocol, Ecoinvent database. Please see Gold and climate change: Current and future impacts and Gold and climate change: An introduction.

See Chart 13, p9